2023 UK Construction & Property Market Review

Intro

As a software and services business providing construction and property information management solutions, we at Operance must regularly review the market and look for anything that could impact us as we grow. Your own organisation no doubt goes through similar exercises.

Listening to or reading the global economic news can often feel like there is a lot of doom and gloom, and understandably so in some respects. But obviously, we dig deeper than this to get a truer picture of what could impact our actual markets, verticals and, therefore, our individual business.

Economic conditions, government policies, and supply and demand dynamics influence the growth of the UK construction and property market. Therefore, after having done the exercise for ourselves, we felt it might be valuable to our audience if we shared this with you too. So here’s an overview of the following:

Growth: is the sector expected to grow or decrease over the next few years?

Trends: what are the common needs and wants of the industry?

Challenges: where and what are the biggest concerns the industry is likely to face?

Opportunities: where and what are the biggest opportunities the industry could benefit from?

Growth

Construction

Despite the global COVID pandemic and the economic downturn, the UK construction market (including was valued at £381.74 billion in 2023, with an expected annual average growth rate (AAGR) of more than 24% between 2023 and 2027 to £476.6 billion (Statista).

This figure includes all construction-related activities, including new construction, repairs and maintenance, and infrastructure.

This growth is expected to be driven by a combination of factors, including increased government investment in housing, education, defence, health and transport infrastructure, a rising demand for new housing, energy, telecommunication and data infrastructure, and the ongoing need for repairs and maintenance of existing buildings.

It’s worth noting that the construction industry has been impacted by the COVID-19 pandemic, which has led to disruptions in supply chains, delays in projects, and reduced demand in some areas. However, as the pandemic continues to be controlled and economic activity resumes, the UK construction market is expected to recover and grow over the coming years.

Property

The market size, measured by revenue, of the Property Management Services industry in itself is £29.2bn in 2023, resulting in an expected increase of 5.5% growth (IBISworld).

Despite COVID, there has been an average 0.3% growth rate per year between 2018 and 2023. The market size increased faster than the economy overall.

This could be as a result of increased costs involved in keeping occupants safe during the pandemic and as a result of more stringent legislation.

Trends

Here we delve into the most common known trends across both the UK construction and property industry:

Construction

- Increased focus on safety regulations and compliance: Following the 2017 Grenfell Tower fire tragedy and many other building safety concerns around the world, there is a growing focus on safety regulations and compliance. Our Operance software solution helps building owners and contractors comply with these regulations and ensure their buildings are safe.

- Growing demand for sustainable buildings: There is a growing demand for sustainable buildings that are energy-efficient and environmentally friendly. Operance plans to help building owners and contractors design and manage sustainable buildings by collecting and sharing data to hep make better-informed decisions.

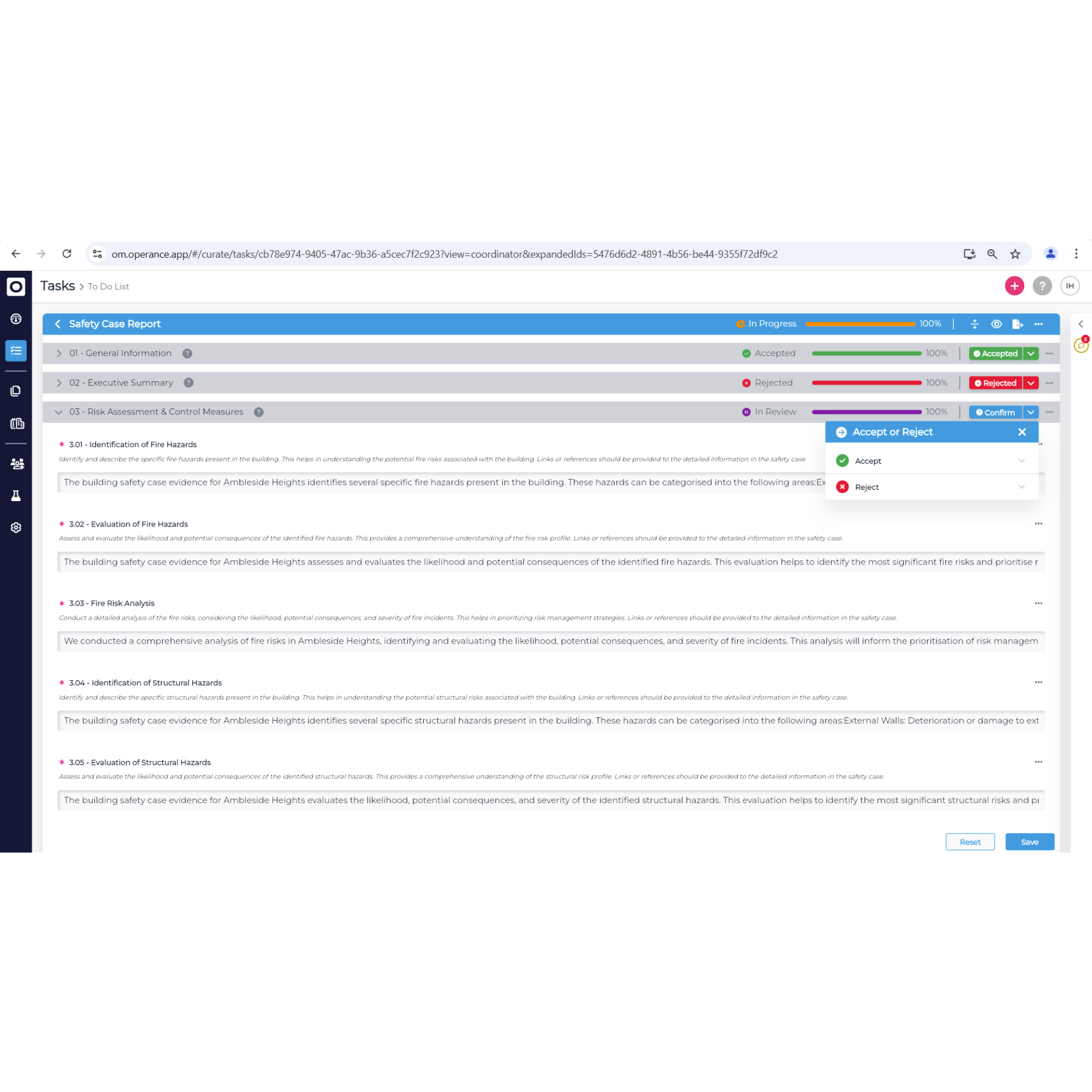

- Digitisation of the construction industry: The construction industry is moving towards digitisation at it’s most rapid rate ever. There is a growing demand for software solutions that can help manage the construction process. Our software solution helps streamline the construction process and improve efficiency in terms of building information coordination.

- Increasing demand for building information modelling (BIM) solutions: BIM has become essential for the construction industry, enabling stakeholders to create and manage digital representations of building designs and data. This allows for a more collaborative and efficient approach to building design and construction. With the growing importance of digitalisation in the industry, the demand for BIM solutions is expected to continue to increase, which bodes well for our BIM-ready Operance solution.

- Increasing adoption of cloud-based solutions: The adoption of cloud-based software solutions is growing in the construction industry, enabling stakeholders to access and share information in real-time from anywhere. Our Operance business benefits from this trend by offering cloud-based functionality that will enable users to collaborate and access information on the go.

- Emphasis on facility management: There is a growing emphasis on facility management as building owners and operators look to improve the efficiency and effectiveness of building operations. Our Operance software will provide a comprehensive and single-source-of-truth spanning both construction and facility management needs for building owners, operators, contractors and occupants.

Property

- Increasing demand for affordable housing: There is a growing demand for affordable housing around the world, particularly in the UK, driven by factors such as rising living costs, stagnant wages, and changing demographics. This has put pressure on social housing providers to provide more affordable and accessible housing options.

- Focus on energy efficiency and sustainability: Social housing providers are increasingly focused on energy efficiency and sustainability, driven by factors such as rising energy costs (as a result of global unrest), environmental concerns, cost savings, and regulatory requirements.

- Technological advancements: The social housing sector is increasingly adopting technological advancements, such as digital platforms and smart home technologies, to improve efficiency, reduce costs, and enhance tenant experiences. This also includes the use of mobile apps for communication and payments, cloud-based property management software, and IoT devices for remote monitoring and control of properties and automation. Being the single-source-of-truth for potentially all types of building information, the ability for Operance to integrate with various digital sources to pull data into one environment is a powerful opportunity.

- Growing use of data analytics: Property managers are leveraging data analytics to gain insights into property performance, tenant behaviour, market trends and better understand tenant needs and preferences to improve service delivery. This enables them to make more informed property management strategies, pricing, and marketing decisions. With more users and data being added to our platform daily, Operance could be a valuable source of informative data for users.

- Regulatory changes: The social housing sector is subject to changing regulatory frameworks, such as new housing policies, tenancy laws, new rent control laws and of course, building codes and legislation particularly focussed on building safety (including fire, structural and M&E equipment), which can impact profitability, funding, operations, and service delivery. Our Operance Building Safety product is potentially the world’s first bespoke solution to meet these needs.

- Emphasis on tenant well-being: There is a growing recognition of the importance of tenant well-being in the social housing sector, driven by factors such as mental health concerns, social isolation, and ageing populations. Providers are investing in initiatives to support tenant well-being, such as community events, social programs, and health and wellness services.

- Increased focus on tenant experience: Property managers are placing a greater focus on the tenant experience, recognising the importance of tenant satisfaction, retention and safety. This is particularly important to Operance and our users as we develop a solution to the Residents Voice, a key part of the new Buidling Safety legislative regime. There is also the opportunity for us to combine our building operations and safety products with tenant lifestyle management solutions, as customers also invest in amenities and services that enhance the tenant experience, such as fitness centres, community spaces, and on-site concierge services.

Challenges

The UK construction and property industry faces a range of challenges, including:

- Compliance: The Building Safety Act aims to improve the safety of higher-risk (residential) buildings (HRBs). It presents a number of challenges for industry, such as:

- Implementation: The Act sets out a range of new requirements for building safety, particularly the need to produce digital information and a lifecycle audit trail for new and old HRBs. Implementing these changes will require significant resources and investment from both the public and private sectors. This is also relevant to the government itself, with the establishment of a new Building Safety Regulator (BSR).

- Funding: The cost of implementing the new safety requirements will be substantial, and it is not yet clear exactly what these costs involve and how these costs will be funded. For more information on this, read our article; The Ultimate Guide to Building Safety Budgets.

- Capacity: The Building Safety Regulator itself will need to recruit a significant number of staff to oversee the implementation of the new safety requirements. But also, all our Buidling Safety product customers will need to find additional staff and/or external support to help develop their Golden Thread of Information, a central pillar of the new regime. There are concerns that insufficiently skilled professionals may be available to fill these roles. Hence, Operance has teamed up with Morgan Sindall Property Services to help our customers in this respect.

- Liability: The Act places new responsibilities on building owners and managers to ensure the safety of their buildings. There are concerns that this may increase their liability and expose them to legal action if something goes wrong.

- Disruption: The Act is likely to cause significant disruption to the construction and property industries as they adjust to the new safety requirements. This may lead to delays and increased costs for new developments. For instance, there is a requirement to introduce a second staircase within tall buildings; this in itself has caused time delays as projects are completely redesigned and will add billions of pounds on top of development costs over the next decade at least.

- Public Confidence: The Act is designed to improve public confidence in the safety of high-rise residential buildings. However, there are concerns that the Act may not go far enough to address the underlying issues that led to the Grenfell Tower disaster and that public confidence in the industry may be slow to recover.

- Gateway Management: Gateways are a new requirement of the Building Safety Act; they provide windows of opportunity in which to check information has been provided in line with the prescribed requirements. Obtaining planning permission at Gateway 1 can already be a long and complex process, which can delay the start of projects and increase costs; additional fire safety information requirements could add to this. Not having the correct information at Gateways 2 and 3 could result in the regulator preventing projects from starting on-site and from buildings being handed over. The Operanc platform aims to help with his process and alleviate the risk of non-compliance by helping users define, curate and access the information they need at each Gateway.

- Sustainability: The industry is under pressure to reduce its carbon footprint and adopt sustainable building practices. This requires significant investment in new technology, materials, and processes, which can be expensive.

- Infrastructure: The UK’s infrastructure is under pressure, particularly in urban areas. This can lead to congestion, delays, and increased costs for construction projects.

- Health and Safety: The industry has one of the highest workplace accidents and fatalities rates. Companies need to invest in training and safety measures to improve worker safety.

- Innovation: The industry has been slow to adopt new technologies and processes, which can lead to inefficiencies and higher costs. Companies need to invest in research and development to stay competitive.

- Labour Shortages: The industry is facing a shortage of skilled workers due to an ageing workforce, Brexit, and the pandemic. This has led to delays and increased costs for many projects.

- Cost Inflation: The cost of materials, labour, and land has been increasing rapidly in recent years, putting pressure on profit margins and making it harder to deliver projects within budget.

Opportunities

The UK construction and property industry could benefit from a range of opportunities, including:

- Sustainability: With the increasing focus on environmental sustainability, there is a growing demand for more eco-friendly buildings and infrastructure. The UK construction and property market has the opportunity to take a lead in this area by investing in sustainable materials and methods of construction, as well as retrofitting existing buildings to be more energy-efficient. New growth markets such as this result in a whole raft of new products and information to serve the market.

- Affordable Housing: The UK has a significant shortage of affordable housing, particularly in urban areas. This presents an opportunity for developers to invest in the construction of new affordable housing units and refurbish existing properties to increase their affordability.

- Infrastructure: The UK has an ageing infrastructure that is in need of significant investment. This includes transport infrastructure, such as roads and railways, and utilities such as water and electricity. Investing in infrastructure and in serving the market could boost economic growth.

- Modern Methods of Construction (MMC): Modern methods of construction are gaining popularity as a way to increase efficiency and reduce waste in the construction process. MMC involves the use of offsite manufacturing, modular construction, and other techniques to speed up construction and reduce costs.

- Technology: The construction industry has traditionally been slow to adopt new technologies, but this is changing. There are many new hardware technologies that could improve efficiencies and safety, such as the use of robots which are used on sites across the country, as is the use of drones and 3D scanning.

- Software: Because of the demand to digitalise an industry that has historically been the bottom of the league in terms of productivity, software solutions to age-old problems are required across the board. Solutions such as golden thread and building information modelling (BIM) tools reduce costs and also increase safety.

- Consultancy: The need for guidance and advice through such a huge transition is crucial. Many businesses looking to invest in new technologies are decades and even centuries old. It can seem like a big jump, and the cost of opportunity can be unclear given they have served and survived for so long without change. Investing in consultants to help understand the benefits and provide a helping hand in taking the first steps could be a great return on investment in the long run and ensure their businesses thrive into the next decade and beyond.

Outro

The future of the industry as a whole also looks to be relatively rosey. Yes, there are challenges, our industry is going through perhaps one of the biggest industrial movements in history with the acceptance and move towards digitisation, something that had been needed for a very long time.

Facilities management is a rapidly evolving industry itself, with several key trends and developments shaping this particular market. But overall, overall, the construction and poperty market is undergoing a significant transformation driven by technological advancements, sustainability, data analytics, outsourcing, and workplace transformation. As the market continues to evolve, it is likely that we will see further innovation and disruption in the years ahead.

From a selfish perspective, these trends and developments suggest a bright future for our golden-thread-ready Operance software solution as it helps meet the growing demand for safety, sustainability, digitisation, BIM integration, and facility management in the construction industry.

But why now?

Well, with time, along come new generations. Younger, more expansive minds wish to drive change and create a more sustainable and productive future for themselves. We started our business over 8 years ago now, and if our cofounders received a pound for every time an ‘old-timer’ suggested “BIM, that’ll never happen!”, then they would have probably retired by now!

So age and experience, or the lack of, can greatly affect disruption. But, perhaps the biggest driver of all in this country right now, is a tragedy. Without Grenfell, would we have the new buidling safety regime and all related legislation that we have now? Probably not, and we would probably not be pushing for digital information at the current rate.

So strap in and be ready for what promises to be a defining year for both your construction and property career and your organisation’s business development!

NEWSLETTER

Revolution Is Coming

Subscribe to our newsletter so we can tell you all about it.

You can unsubscribe at any time and we don’t spam you.